One of the most important parts of owning or leasing a vehicle is having car insurance. Driving uninsured is not only risky and potentially disastrous, but also illegal in most states. The penalty for driving uninsured is often a large fine, or the suspension of your driver’s license.

However, there are many reasons to cancel car insurance. Obviously, when you sell or get rid of a vehicle, you won’t want to continue paying for insurance. You may also be traveling out of the country and not need your car for a few months. Or, you may simply have found a more affordable insurance company, or an insurance policy that better fits your needs. For whatever reason, if you determine that your insurance policy is no longer needed, you’ll want to cancel it - which is a relatively straightforward process, as described below.

Part 1 of 2: Review your current insurance policy

Step 1: Figure out your existing insurance policy. Review and find the details of your current car insurance policy.

Some insurance policies are on a month-to-month or quarter-to-quarter basis, meaning that you’re never locked into your policy, but rather on a pay-as-you-go basis. If this is the case, you can cancel your auto insurance at any time.

Other insurance policies require you to sign a binding contract, guaranteeing that you’ll continue to pay for the policy for a certain amount of time. However, car insurance companies will often drop this contract if you no longer have a car to insure. For instance, if your car has been totaled or the owner of the vehicle has passed away, the insurance company will likely be willing to waive the contract.

- Note: If you have time and money remaining on your insurance policy contract, you will not be able to simply cancel it and move to a new insurance policy. You will only be able to cancel such a policy if you no longer need the vehicle insured.

Step 2: Contact your insurance provider. Reach out to your insurance provider if you are still under contract.

If you are locked into a policy, give your insurance provider a call or visit a local office of theirs. Explain your situation and tell them why you no longer need car insurance. They will be able to tell you whether or not you can cancel your plan.

- Tip: If you do this at an office of the insurance company, you will likely be able to cancel your policy on the spot.

Part 2 of 2: Cancel your insurance policy

Step 1: Cancel your policy. Contact your insurance provider and cancel your policy.

Reach out to your insurance company to figure out the best way to cancel your policy. Some insurers will let you cancel on the phone or online, while others will require you to send a notification in the mail.

Follow the instructions of your insurance provider, and cancel your insurance policy.

- Tip: Regardless of how you cancel your policy, it is a good idea to mail a physical letter to the insurance company, informing them of your cancellation. That way, you can keep a hard copy for your records, should there be any mix up.

Step 2: Sign any necessary documents. Sign any documents provided by your insurance company.

Many insurance companies will require that you sign a document confirming your cancellation. This is to protect the insurance company from you claiming that you never canceled. If this is required, sign the document they provide.

- Tip: If you are canceling your insurance policy because you found a more affordable or comprehensive policy elsewhere, your current provider may offer you a better deal on your coverage. Be sure to listen to your insurance provider before canceling, as you may find that they ultimately will provide the greatest deal for you and your vehicle.

Step 3: Cancel your automatic payment. Cancel the automatic payment that you had for your insurance plan.

After canceling your plan, be sure to cancel your automatic payment, if you had signed up for it. By canceling your automatic payment, you ensure that you will not be erroneously charged for insurance.

- Tip: You cannot just cancel your automatic payment or stop paying by other methods, and expect your insurance to be canceled. If you abstain from paying without ever canceling your plan, you still owe all of the money, plus any late fees that have accrued.

Step 4: Contact the DMV. Contact your local Department of Motor Vehicles office.

Call or visit your local DMV office, and let them know that you have canceled your insurance policy. Let them know why you canceled, and whether you are keeping your car and switching to a new company or policy.

- Tip: If you are canceling your insurance because the car is totaled, being sold, or being donated, you may have to turn in your registration or your license plates to the DMV.

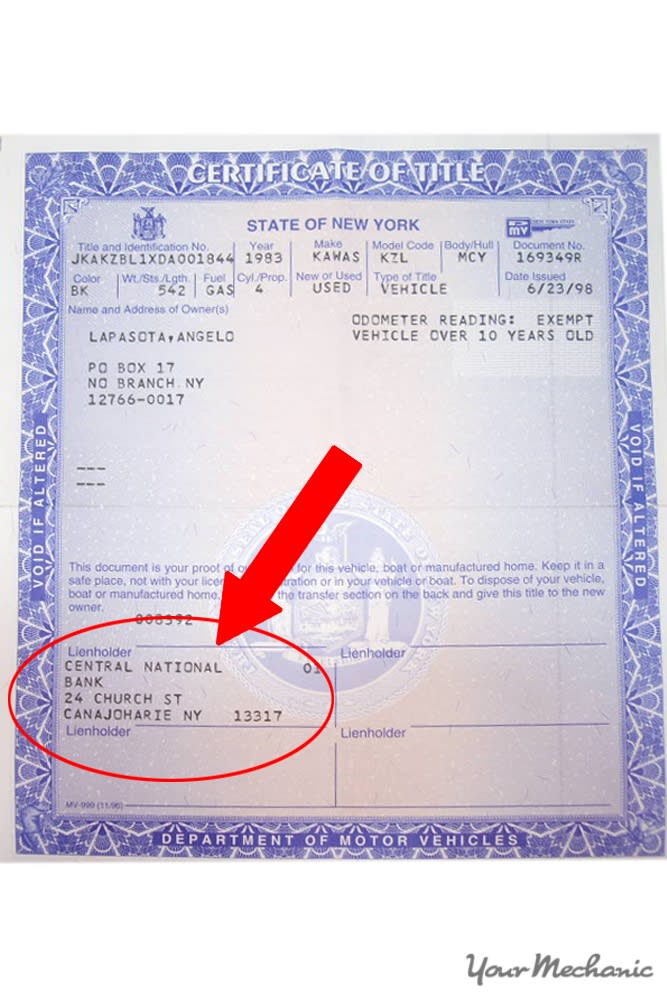

Step 5: Contact your lienholder. Inform your lienholder of your insurance cancellation.

If you are still making payments on your vehicle, you will have to alert your lienholder of your insurance cancellation.

Most lienholders require you to have insurance on your vehicle, as it offers them protection on their loan. Let them know why you are canceling, and if you are keeping your vehicle and purchasing insurance from a different company.

Canceling your car insurance isn’t hard at all, and the process shouldn’t take you very long. It is important, however, that you never have a lapse in car insurance. If you are switching providers, make sure that your new policy takes effect by the time your old policy ends. If there is a gap between your cancellation and the beginning of your new policy, then you should not drive your vehicle.