Let's face it: cars don't come cheap. When you're just getting started out in college or at a new job, buying a car can seem like an insurmountable obstacle due to the high price tag attached.

Your credit score is usually a three-digit number that ranges between 300 and 850, and it is based on financial information reported to three chief credit reporting bureaus (Equifax, Experian, and Transunion).

Although the actual algorithm used to come up with your credit score is somewhat mysterious, it is based on factors like the number and types of accounts you have, available credit, payment history, and the length of your credit history. If you don't have any of these things, getting a loan can be problematic, since approvals are typically based on these scores. However, since you have no prior credit, you have the advantage of having nothing negative on your credit report.

Although you do not yet have a credit history to prove your intention and ability to make payments on time, it is still possible to get a car loan.

Lending institutions have the option to manually underwrite loans, which is a more creative way of determining your ability to make payments. Since this is more time-consuming and riskier for creditors, try to make their job as simple as possible and present yourself in the best light so that they will give you the loan.

- Tip: You can sometimes pay a small fee to add good history to your official credit report for making on-time payments on services like cable T.V or items like cell phones.

Method 1 of 1: How to get a loan to buy a car

Step 1: Open a checking or savings account. It takes absolutely no credit history to open your first bank account, and it is a necessity for establishing your credit worthiness in the future.

Look at "free" checking account options that don't require a minimum balance or charge a monthly fee until you are more financially established.

Also, be aware of any other fees associated with an account, such ATM or overdraft fees, before you choose a banking institution.

Step 2: Save up a sizeable down payment. While it seems odd that you should save money to borrow money, credit lenders are more likely to approve a no-credit car loan for those who can prove that they have saved money for a big investment like a car.

As you put back the cash for your down payment, you are also establishing a reliable work history, which makes you look like a good investment for your prospective lender.

Step 3: Apply for credit cards. Although you probably won't get a high line of credit, department stores and gas stations often grant credit cards to those with no credit.

You can also apply for many credit cards online and get instant approval.

If you get a card, be sure to make your full payments on time and build a little credit history without incurring any interest.

Step 4: Gather financial paperwork. Amass and organize documentation of your financial history. You may not have an official credit history, but you may have made some sort of payments, such as your monthly cellular or utility bill.

Gather proof of your making payments like these on time as well as your bank statements in order to show your ability to balance a checkbook and budget. This will make you appear more creditworthy.

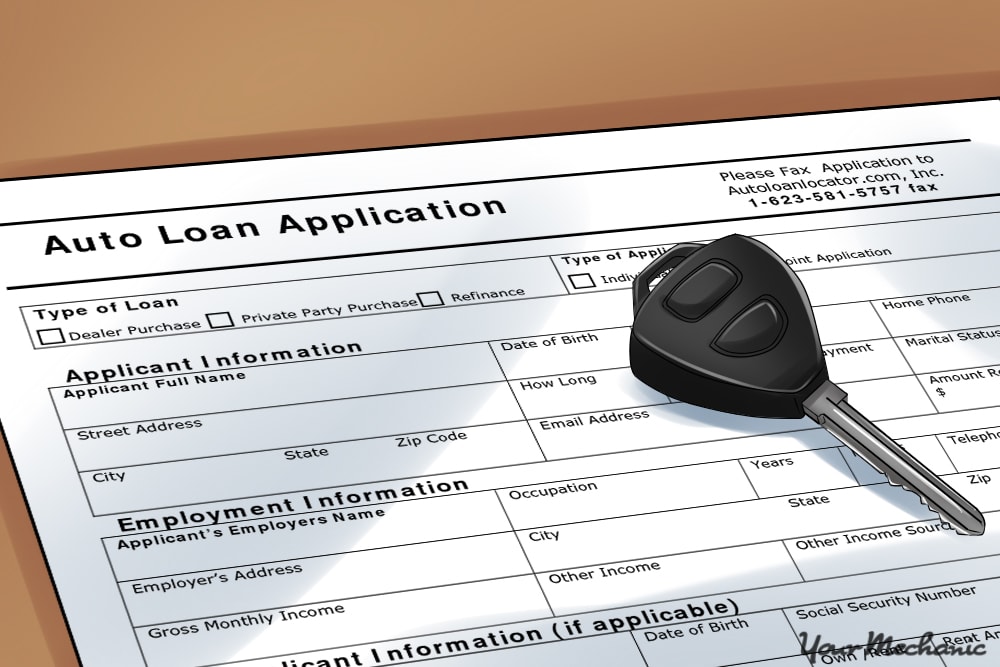

Step 5: Try to get a bank loan. Approach your banking institution about a loan first. Since you already have established a relationship with your bank, it is your best bet to get a car loan with no credit history. Your bank is also motivated to serve you as a customer and can likely offer you the best interest rate.

Step 6: Approach the car dealership. If your bank denies your loan application, consider asking the car dealership with your desired vehicle about loan options.

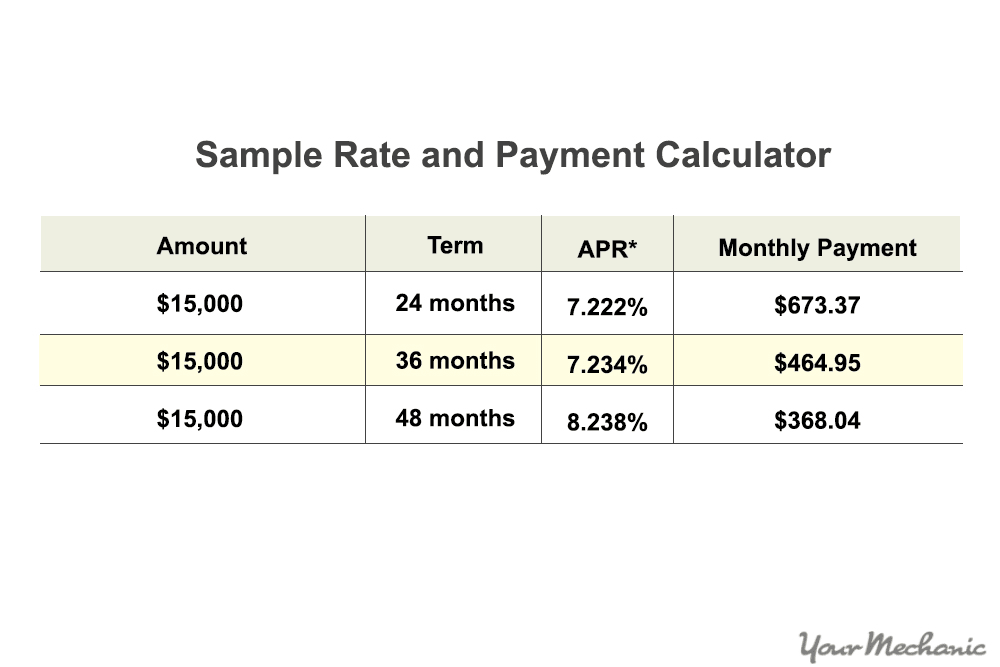

Just bear in mind that, although dealerships are more free with granting loans, the interest rates are usually higher than on loans from banks.

- Note: Don't feel like you have to accept the first loan offered to you. Explore your repayment options in regards to monthly payments and interest rates, and choose the one that best fits your situation.

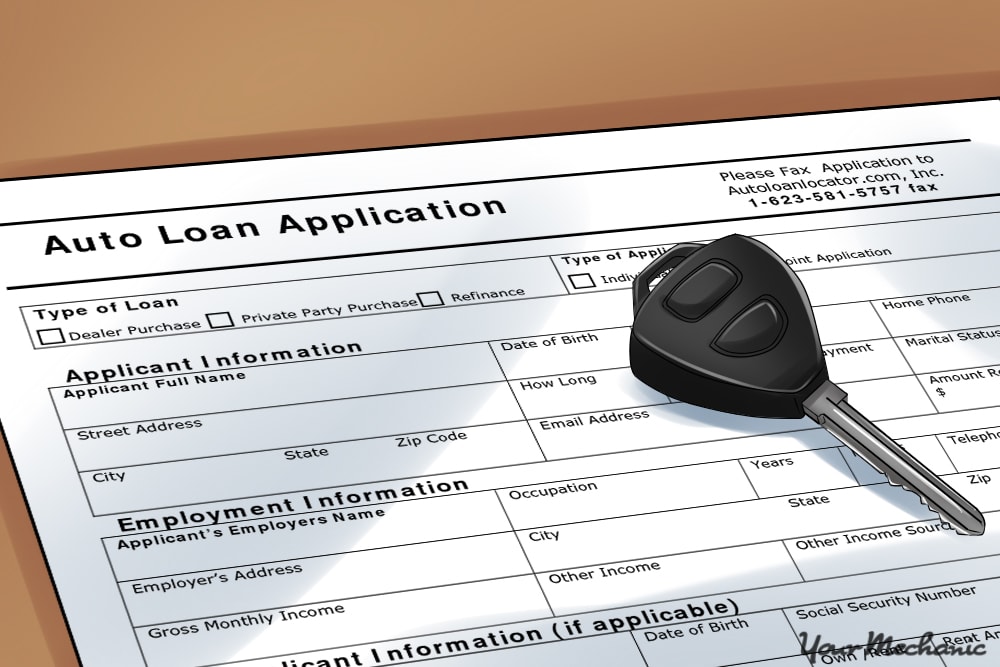

Step 7: Find a co-signer. Ask for help if necessary. It is far easier to get a car loan with no credit if you have a family member or close friend with good credit who is willing to co-sign for you. In that case, the lending institution has the option to seek payments from your co-signer if you are unable to pay.

- Tip: If you go this route in obtaining a loan, it is vital you make your payments on time – not just for your budding credit history but also to maintain good relations with your co-signer.

It goes without saying that once you have your car loan with or without a co-signer, you must make your payments on time. This helps you gain and maintain a good credit score so that you can easily get loans in the future.

Once you have been approved for a car loan and begin to build a credit history, you will have new responsibilities associated with being a vehicle owner. These responsibilities include things like regular maintenance and periodic repairs that can be confusing to new automobile owners.

If you have any questions about caring for your new car or need maintenance or repairs performed, don't hesitate to reach out to the experienced mechanics at YourMechanic for a consultation. Our technicians are established in the industry and can even come to you in cases of emergency to get you back on the road.

You can also get our mechanics to perform a safety inspection of your new car or a pre-purchase inspection of a used car that you plan to purchase.