A few financial missteps can greatly impact your credit score, and it is far more difficult to repair bad credit than it is to gain it.

If you have managed to be branded with a poor credit score, don't despair when it is time to buy a new or gently used car. With the proper preparation and strategy, it is possible for even those with bad credit to get a car loan.

Before you apply for car loans, you need to have an idea of how to appear on paper to lenders and potential creditors. It is crucial that you present yourself in the best light in order to be considered for a loan. For the best results and interest rates in the long term, plan on spending up to six months on preparation, and follow these steps to make a favorable impression:

Method 1 of 1: Buy a car with bad credit

Step 1: Get your credit report. Order your credit reports from Equifax, Experian, and Transunion. These are the primary credit reporting agencies, and your credit score is ultimately determined by what they have on file about your financial practices.

Bear in mind that the reports can vary between the agencies.

- Tip: You are entitled to one free report each year; otherwise, you will need to pay a small fee.

Step 2: Try to improve your credit scores. Assess what you can fix on your credit reports, so you can improve your credit score.

Pay off or make payment arrangements on anything you reasonably can handle. If there are any errors, file a dispute. If applicable, consider consolidation for things like student loans.

Step 3: Add your good credit to your reports. Oftentimes, credit reports do not reflect your good repayment history, which doesn't show potential lenders a full idea of your financial habits. It is, however, possible to add your good credit in many cases, although it does cost a little extra.

Step 4: Begin building new credit. Apply for a secured credit card, which is basically a card on which you have already paid the balance.

Also note that just having the card doesn't do anything for your reports; you must actually use it and pay your bills on time for the positive activity to register on your credit score.

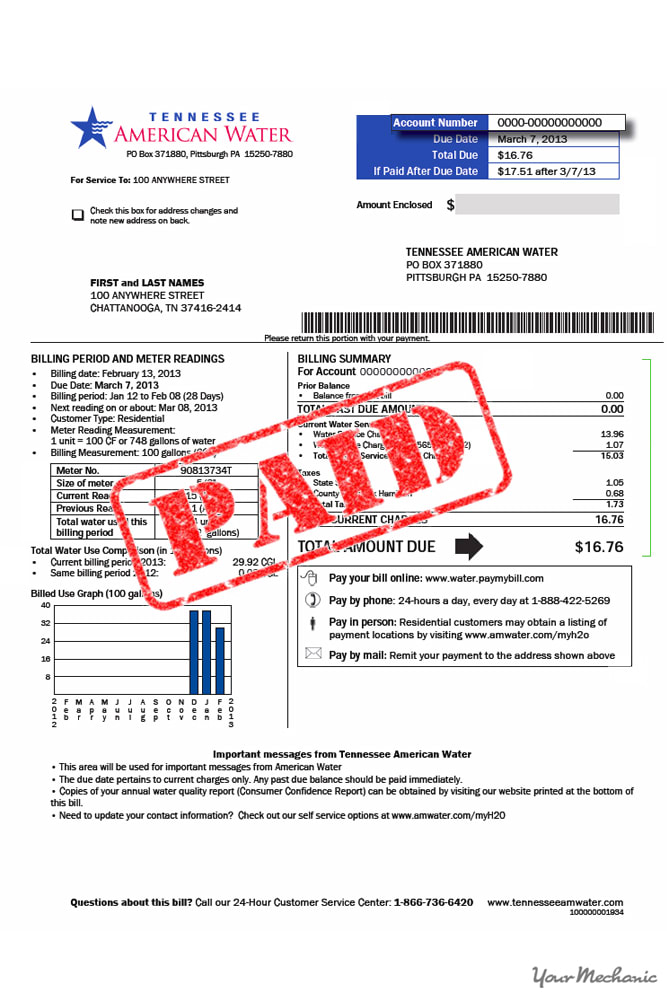

Step 5: Collect your paperwork. Gather any paperwork that is not part of your public credit record, like utility bills or even notarized affidavits from individuals, to show that you pay bills on time.

Lenders can manually underwrite loans to include records that aren't part of your credit report and will be more motivated to take this step when you are clearly trying to repair your credit and having good organizational skills.

Step 6: Apply for a bank loan. Approach your bank about a loan first. You already have a relationship with the institution, so it is your best bet for a loan approval.

Banks also tend to offer the best interest rates, which will make it easier for you to repay your car loan in the future.

Step 7: Contact your insurance company for a loan. If your bank denies your loan application, then check with your insurance company to see if loan services are part of its array of services.

Like your bank, your insurance company already has you as a customer and will be more likely to approve your loan.

Step 8: Ask the car dealership for a loan. As a last resort, turn to the car dealership that sells the car that you wish to purchase. Dealerships tend to charge higher interest rates, which means you will pay more in the long run, although they approve car loans more freely than banks.

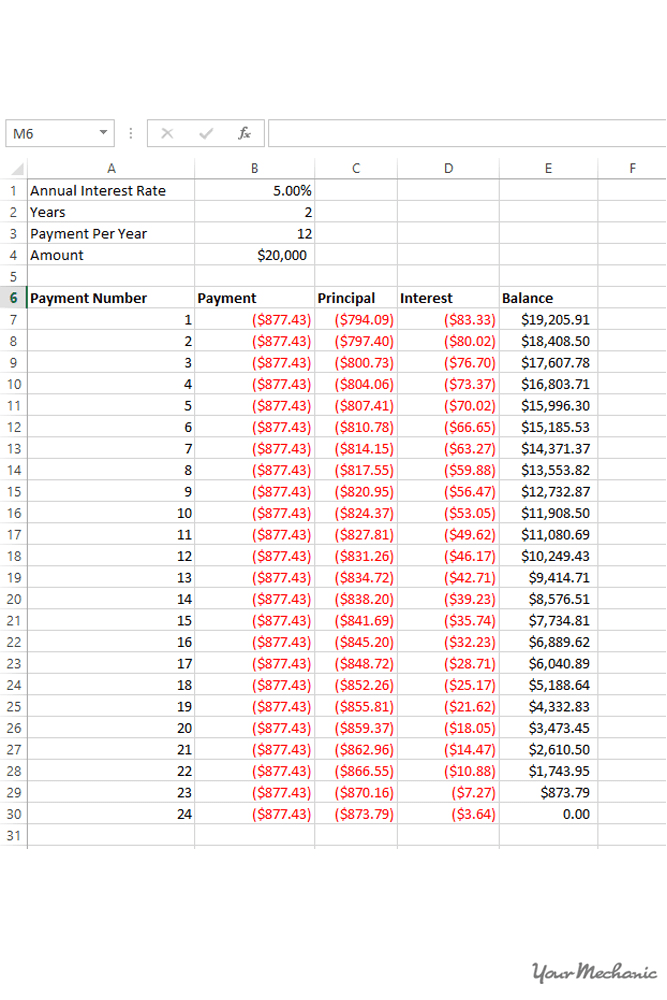

Step 9: Compare all loan options and choose one. Shop around for the best offer and don't automatically sign off on the first loan you are offered.

Read all of the fine print and make sure you understand the terms fully. Weigh your options and be honest with yourself about what you can pay and how long you want to do so.

Make a commitment to a loan only after assessing which loan best fits your needs.

- Warning: Beware of loans that do not have terms that are final. In such cases, your monthly payments could be increased down the line.

Step 10: Ensure timely loan repayments. Once you've obtained your loan and have the keys to your new car, make your payments on time to continue repairing your bad credit. That way, the next time you want to make a vehicle purchase, the process will be fast and smooth.

- Tip: Bear in mind that, after you have made payments on your car loan for a year, you may have the option to refinance at a lower interest rate.

Although the preparation involved to get a car loan with bad credit can be arduous, it is ultimately worth the trouble. Your bad credit doesn't have to last forever, and, after a couple of years of making a concerted effort to repair it, you won't be defined by your past financial mistakes anymore. This will help you to make large purchases such as other cars and even homes in the future.

Once you buy the new car, you have new responsibilities that go beyond just making your monthly payments. You will have maintenance needs and possibly even repairs to deal with in the future.

If you have questions about how to care for your new car or how to maintain it, request the services of an experienced mechanic from YourMechanic. You can also get our mechanics to perform a safety inspection of your new car or a pre-purchase inspection of a used car that you plan to purchase.