It’s no coincidence that the “R” in RV stands for “Recreation.” After all, Recreation Vehicles can be a lot of fun to own and provide a lot of freedom, luxury, and relaxation to many people.

An RV can be its own vehicle or a towable trailer, but either way it will have a living and sleeping space in it. This makes traveling and taking road trips fun, easy, and incredibly relaxing, as RV owners can bypass hotels or campsites, and instead comfortably live out of their vehicle when they’re traveling.

However, purchasing an RV is a little trickier than it initially seems. Because RVs are technically recreational, they are listed as a luxury and not as a necessity, which separates them from traditional cars and homes. As a result, it can be a bit harder to get a loan for an RV, as large loans for luxury or recreational items aren’t handed out as easily as loans for everyday items.

If you’re interested in purchasing an RV, however, don’t let the thought of getting a loan scare or stop you; you should, however, make sure that you’re well-versed in what owning an RV entails. As long as you follow a few simple steps, you should be able to get a loan to purchase an RV.

Part 1 of 3: Make yourself desirable to lenders

Step 1: Work on your credit. Get your credit score as high as possible.

Simply put, a good credit score is the key to getting a loan when purchasing an RV. If you have bad credit, you will likely not be able to find a lender. If you have decent credit you will probably be able to get a loan, but the interest rate will probably be very high.

If you have strong credit (700 or higher), you will probably be able to obtain a good lease at a great price. Once you know that you’re interested in buying an RV, start working on your credit score. Be timely with your payments and pay off as much of your credit card debt as you responsibly can.

- Tip: If you’re trying to find the most effective way to improve your credit score, try calling your credit card company and asking them what you can do to increase your score.

Step 2: Save up money. Save up some money for your RV purchase by budgeting and other strategies.

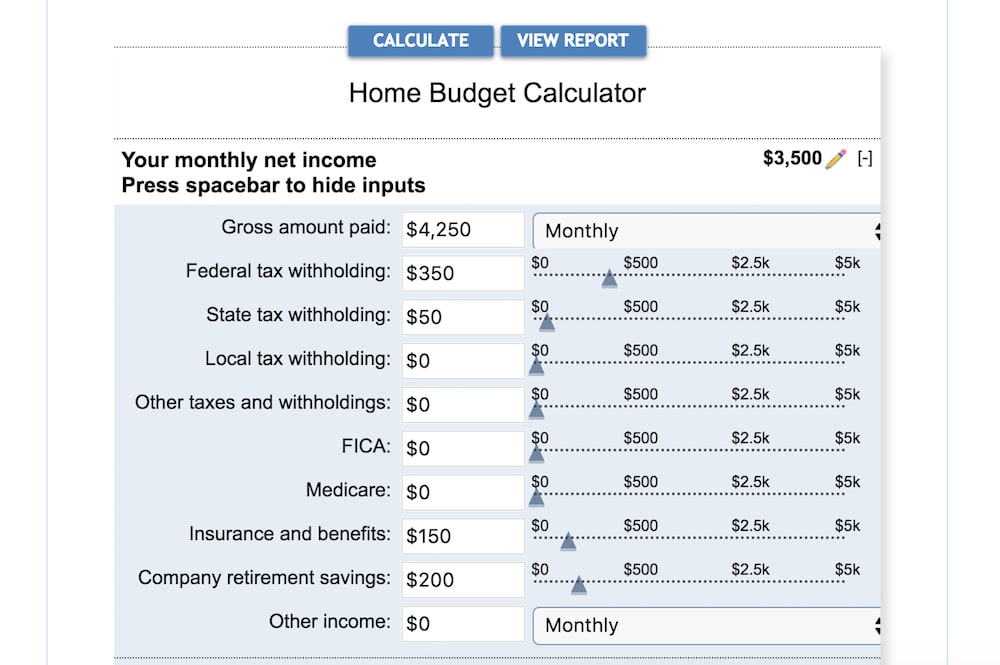

As you begin to think about purchasing an RV, you should start saving money. Bankrate has a useful online budgeting tool to help you accomplish this. The more you have saved for a down payment, the less you’ll need to borrow from a lender, making it more likely that you can get a loan.

Having a large amount of money saved for a down payment also shows lenders that you’re financially responsible, which will make them more likely to give you a loan.

Step 3: Improve your DTI ratio. Improve your debt-to-income ratio as much as possible.

Your DTI ratio is the amount of money you owe each month to lenders (for your credit card, student loans, auto payments, mortgages, and any other debts) relative to the amount of money you make every month.

The lower your ratio (“low” meaning that your debt is low relative to your income), the more desirable you are to lenders.

If possible, try to improve your DTI ratio before purchasing an RV. For instance, considering selling one of your cars to eliminate that debt, or refinancing your mortgage to lower your monthly payments. If you have a debt that’s going to be gone soon (such as a car that you have almost finished paying off), wait until it is gone before trying to get an RV loan.

Part 2 of 3: Consider your loan options

Step 1: Get a dealer loan quote. Take a look at the financing options from the RV dealer.

After you’ve found the RV that you want to buy, talk with salesperson about dealer financing. RV dealerships don’t finance as frequently as car dealerships, but there’s still a good chance that they’ll offer you a loan. However, don’t immediately accept it no matter how good the loan sounds.

Step 2: Explore other leasing options. Seek out other options for an RV loan.

Call or visit some local banks, credit unions, and auto lenders, and see what they can offer you in terms of an RV loan.

- Tip: Be sure to have your credit score and DTI ratio information handy when calling about leasing options, or else you may not be able to get an accurate quote.

Step 3: Compare options. Compare all of your RV loan options on your own or with an online tool.

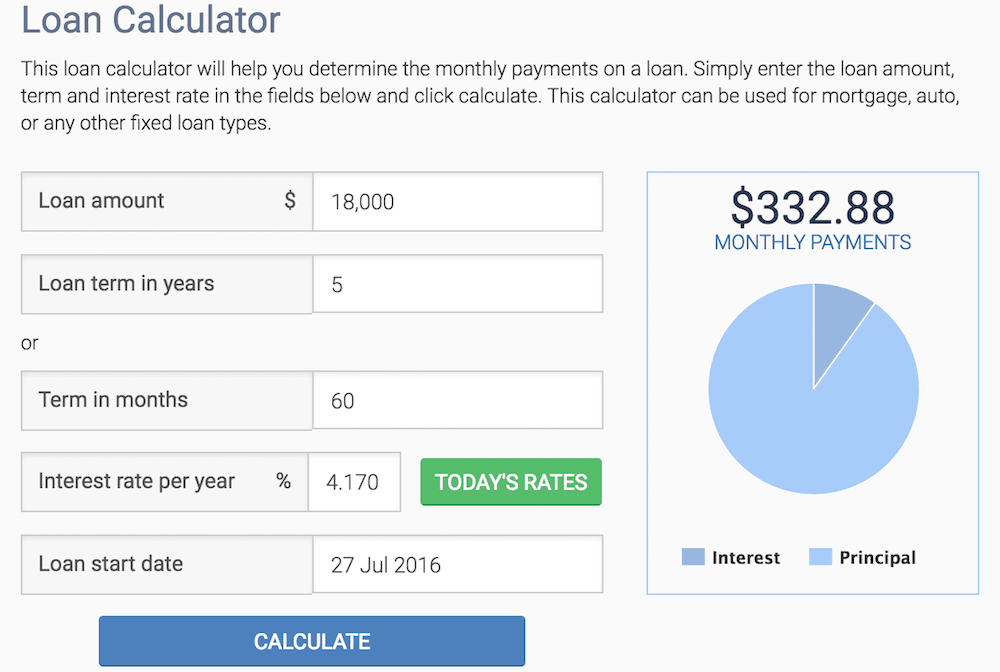

Bankrate has a helpful tool to assist you in figuring out the specifics of loan options. After talking with third party lenders and the RV dealership, choose the loan option that is best for you.

Part 3 of 3: Finalize your loan details

Step 1: Choose your down payment. Select how big of a down payment you would like.

After agreeing on an RV price, and a loan option, you’ll have to make your down payment. A higher down payment means a lower overall price, as you’ll be taking out a smaller loan, and therefore accruing less interest.

- Warning: While a large down payment is ideal, make sure that you can responsibly afford the price you are committing to with your initial payment.

Step 2: Choose loan terms. Agree with your lender on the terms of your loan.

While you and your lender will have already agreed on an overall loan price, you probably haven’t worked out the loan details. Negotiate with the lender to find the terms that are best for you.

Selecting loan terms is all about finding what best fits your financial situation. A shorter loan means you’ll owe more money every month, but less money overall. A longer loan means affordable monthly payments, but more time for interest to accrue, and therefore a higher overall price.

RVs can be a lot of fun, and add a lot of comfort and practicality when you are traveling. As long as you follow these tips, you shouldn’t have any problem getting a loan so that you can purchase the RV of your dreams and hit the open road. If you have any mechanical questions about your RV, be sure to Ask a Mechanic for some quick and helpful advice.